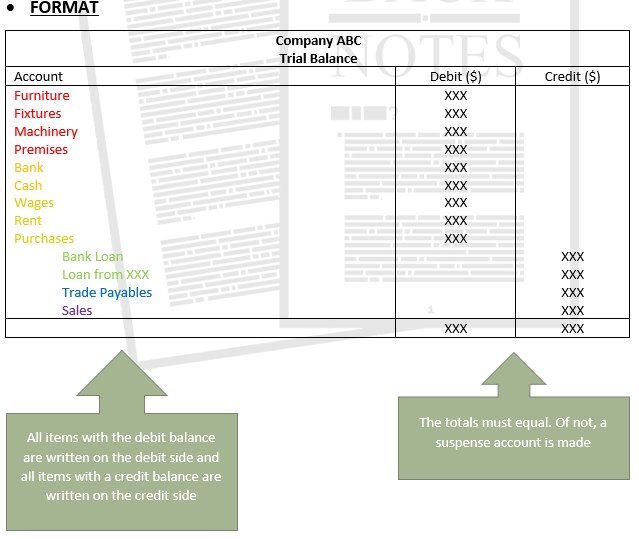

Trial Balance

- Trial Balances are prepared at the end of an accounting period. The balances from all the accounts are transferred to it. It is made for the purpose of making sure all the accounting records are arithmetically correct.

It is not a part of the double-entry system and is just a list of the balances. The trial balance is also helpful when a business prepares further business statements

PREPARATION

- The trial balance only contains accounts which still have money in them. If the total on the debit side is larger than the total on the credit side, then the balance (Balance b/d) is a debit balance, and is written in the debit side of the Trial Balance, and the same thing is applicable for the credit side and credit balances.

It should also be noted that if the balances are listed, then you have to make use of PEARLS to know what is on the debit side and what is on the credit side.