Introduction to Accounting

The Components of Accounting

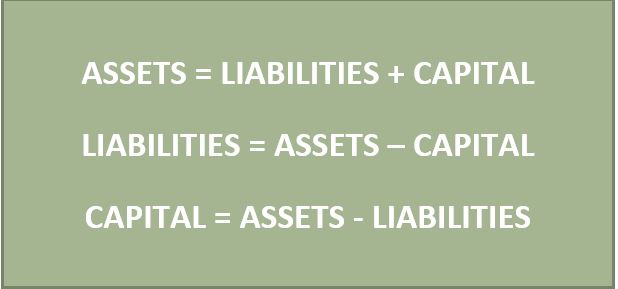

The main terms required to be learnt while studying accounting are assets, liabilities and capital. Assets are items owned by the business, while liabilities are what they owe to other businesses. Capital – also known as equity – is the amount invested by the owner(s) of a business into the business. These three components make up the accounting equation.

Types of Assets

There are two types of assets: Current Assets and Non-Current Assets.

Current Assets are items which a business expects to convert into cash within the next 12 months. This includes inventory, cash at bank, cash at hand and trade receivables.

Non-Current Assets are items which a business owns for a long period of time (Expected to last for over 12 months). This includes the premises of the business, machinery and vehicles.

Types of Liabilities

There are two types of liabilities: Current Liabilities and Non-Current Liabilities.

Current Assets are debts which the business is expected to pay within the next 12 months. This includes trade payables and loans due within the next 12 months.

Non-Current Liabilities are amounts the company is due to pay after the period of 12 months. This includes loans and borrowed money.

The Basics of Accounting

- There are two main sub-sections of accounting. These are book-keeping and accounting.

- Book-keeping is the recording of financial transactions. The foundation of the detailed recordings of transactions is double-entry book-keeping. Double-entry book-keeping says that for every financial transaction, there are two effects on opposite sides.

- Accounting makes use of the detailed records from book-keeping to make financial statements for a specific time period. These financial statements include the income statement and the statement of financial position.

- The income statement shows the profits earned by a business for a certain period. It has the Revenue with Costs of Goods Sold subtracted, giving Gross Profit. Any other incomes and expenses are added and subtracted to the gross profit to get Net Profit.

The statement of financial position compares all assets, liabilities and equity of a business at a certain date and is validated with the accounting equation