Government Microeconomic Intervention

Regulation

○ Regulation is a rule/law that is imposed on the economy by the government, with the intention to control consumption and production.

○ Regulation is a non-market-based approach to fix market failure

○ They do NOT work through price mechanism but rather through command/control approach to fix market failure

Command / Control approach

Command → simple commands enacted by the government in the shape of bans, limits – like age limit, caps on the number of products that can be produced, etc.

Control → simple enforcement so people have the incentive to abide by the command.

If control and command is strong, then there is an incentive for producers and consumers to change behavior and thus potentially solving market failure therefore we obtain allocative efficiency and welfare benefits.

BUT

○ Regulation is very costly as it requires enforcing (constant policing)

○ If regulation is too strict, then firms may try move to exploit the system, through black markets and

Smuggling. Many firms may leave or stop production (Followed by unemployment).

○ If regulation is too lax, then regulation will NOT change behavior to solve market failure

○ Similarly, consumers may attempt to find alternatives through black markets.

○ Regulation is very paternalistic in nature as it is very dominating and unnecessary if market failure is not even that significant to begin with

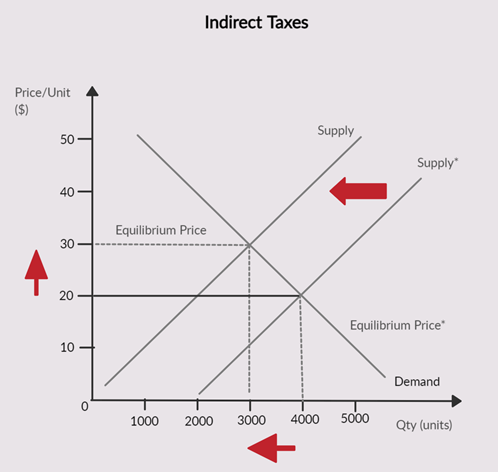

Indirect Taxes

○ Indirect taxes are taxes that are levied on goods and services and increase the cost of production.

Note that this burden can be transferred to the consumer via higher pricing.

○ Indirect taxes will increase the cost of production, thus shifting the supply curve to the left. This will mean higher pricing and lower quantity demanded

Indirect taxes are revenue for the government which can be reinvested and be put to better use in the

economy as government spending.

○ Solves the overconsumption and overproduction in an economy.

BUT

○ If PED is inelastic then quantity will decrease proportionally less compared to a change in price,

therefore, not enough to solve the market failure. (Check Chapter 2: The price system and microeconomy

In backnotes for better clarity)

○ If overtaxed, then firms may try move to exploit the system, through black markets and smuggling.

Many firms may leave or stop production (Followed by unemployment). Overtaxing is very regressive,

meaning it will affect the poor more than the rich

○ If undertaxed, then indirect taxes will NOT change behavior to solve market failure

○ Governments may unintentionally promote income inequality

○ Similarly, consumers may attempt to find cheaper alternatives through black markets.

○ Indirect taxes are paternalistic in nature. It limits consumption and production which may not be desirable if market failure is insignificant.

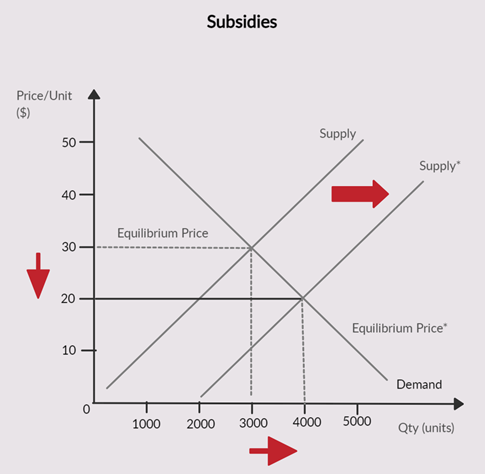

Subsidies

○ Subsidies are money given by the government to lower the cost of production and encourage an increase

in output.

○ Subsidies will lower cost of production, thus shifting the supply curve to the right. This will decrease

price and increase the quantity demanded.

○ Solves the underconsumption and underproduction in an economy.

BUT

○ Subsidies is a government spending. (You can argue that the money could have been used elsewhere)

○ If over subsidized, then is regarded as an extra cost for the government. Producers may be overly dependent on the subsidies.

○ If under subsidized, then subsidized will NOT change behavior to solve market failure

○ If PED is inelastic then quantity will increase proportionally less compared to a change in price, therefore, not enough to solve market failure. (Check Chapter 2: The price system and microeconomy for better clarity)

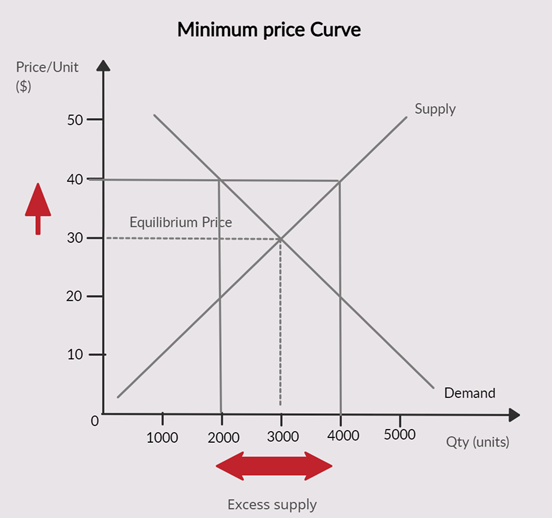

Minimum Price

○ The minimum price is used to solve overconsumption and overproduction of a demerit good.

BUT

○ If PED is inelastic then the decrease in quantity will be proportionally less compared to a change in price. Demerit goods are mostly inelastic goods because of addiction.

○ Minimum pricing may be more regressive as they burden the poor with higher pricing, this may widen the income inequality

○ Consumers may look for alternatives through black-markets

○ If minimum price is set too high, then firms may leave the country, therefore contributing towards unemployment.

○ If minimum price is set too low, then minimum pricing will NOT fix overconsumption and overproduction of demerit good as quantity won’t decrease to social optimum

○ Leads to a surplus, therefore allocative inefficiency

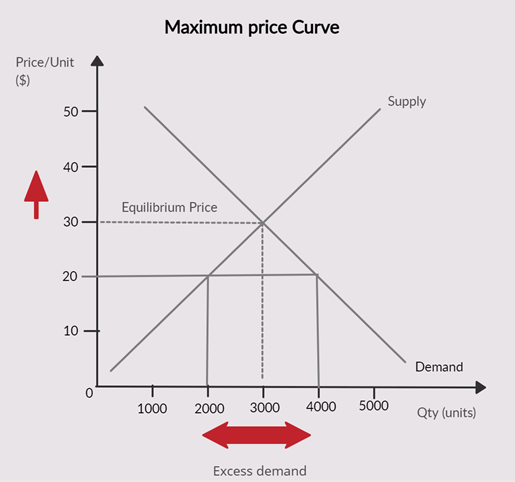

Maximum Price

○ Maximum prices are used to solve underconsumption and underproduction of a merit good

BUT

○ Consumers, whose demand are not met, may look for alternatives through black markets

○ If the maximum price is set too high, then maximum pricing will NOT fix underconsumption and the underproduction of merit good as quantity won’t decrease to social optimum

○ If maximum price is set too low, then there will be a greater shortage in the market.

○ This leads to a shortage, therefore allocative inefficiency

○ Enforcement costs to prevent exploitations in black markets.

○ Costly for governments to fix surplus (governments must purchase excess stocks)

Transfer Payments

○ Transfer payments is when tax revenue or other means of payments are used by the government to

distribute to certain members of the community like the elderly, disabled, unemployed, or even children.

○ The extent to the transfer payments depends on tax revenue and other payment methods.

○ Transfer payments may equitably distribute incomes, however, may demotivate employment. The incentive to work decreases as benefits are high for the unemployed, as a result, may lead to allocative inefficiency

Direct provision of goods and services

○ Direct provision of goods and services reduces inequalities by providing important services free of charge.

○ These are done by providing transfer payments and merit goods.

○ Market may over-provide goods and services which leads to dependence.

○ An argument can be made to lower taxes and let consumers pay for the goods and services.

Nationalization

○ Nationalization is the process of taking the industry into public ownership

○ running in the hands of the government

○ Greater economies of scale because of large size

○ More focused towards service provision / welfare benefits

○ Outputs are most likely to reach optimum levels, as the government will stop overconsumption/production and underconsumption/production of goods and services

○ Public sector has more control over macroeconomy, to face inflation, unemployment, etc.

BUT

○ May lead to diseconomies of scale because of lack of motivation or communication.

○ Lack of incentive to reduce waste or minimizing costs, therefore X inefficiency

○ Lack of supernormal profit (Is a value that considers all the factors to calculate profit) therefore leads to dynamic inefficiency (When money is not being reinvested into the company)

○ Lower competition, therefore higher prices/expensive and lower quality therefore allocative inefficiency

○ Slow innovation and ideas take place and lower technological advancements

Privatization

○ Privatization is the process of taking the industry into private ownership

○ State ran / public organizations are sold off to the private sector

○ Profit motive therefore there is an incentive to allocate efficiently

○ Higher competition will lead firms to be more efficient via lower wastes and lower prices

○ High super profits lead to profits being reinvested into the firm, therefore more innovations and ideas take place and higher Technological advancements

BUT

○ Lower competition will lead to less productivity and allocative inefficiency.

○ Lower service provision/welfare benefits because they are profit-driven.

○ They ignore external costs/benefits because they are profit-driven