Accounting Fundamentals

MANAGEMENT AND FINANCIAL ACCOUNTING

- Management accounting- these accountants prepare detailed and frequent information for internal use by the managers of the business who need financial data to control the firm and take decisions for future success

- Financial accounting- these accountants prepare the published accounts of a business in keeping with legal requirements

INTERNATIONAL FINANCIAL REPORTING STANDARDS (IFRS)

- The IFRS aims to ensure that accounts produced by companies all over the world conform to similar terminology and layout- this is to try to avoid confusion when analysing accounts from companies based in different countries

THE INCOME STATEMENT

- Income statement- records the revenue, costs, and profit (or loss) of a business over a given period of time

- A detailed income statement is usually produced for internal use because managers will need as much information as possible- it may be produced as frequently as managers need the information perhaps once a month.

- A less-detailed summary will appear in the published accounts of companies for external users- it will be produced less frequently, but at least once a year.

- The content of this is laid down by the Companies Acts and provides a minimum of information. This is because, although the shareholders would use additional information to assess the performance of their investment, the published accounts are also available to competitors and detailed data could give them a real insight into their rivals’ strengths and weaknesses.

- Sections of an income statement

- The trading account

- This section shows how gross profit (or loss) has been made from the trading activities of the business

- Sales revenue – costs of sales = Gross profit

- Cost of sales is the direct cost of the goods that were sold during the financial year

- Not all sales are for cash in most businesses, so the revenue figure is not the same as cash received by the business

- Selling price x quantity sold = Revenue

- This section shows how gross profit (or loss) has been made from the trading activities of the business

- Profit and Loss account section

- This section of the income statement calculates both the operating profit (profit before interest/tax) and the profit for the year (profit after tax) of the business

- Gross profit – overhead expenses = Operating profit

- Operating profit – interest costs/corporation tax= Profit for the year

- Limited companies pay corporation tax on their profits before they pay dividends or keep profits within the business

- This section of the income statement calculates both the operating profit (profit before interest/tax) and the profit for the year (profit after tax) of the business

- Appropriation account

- The final section of the income statement shows how the profit for the year of the company is distributed between the owners- in the form of dividends to company shareholders, and a retained earnings

- Dividends- the share of the profits paid to shareholders as a return for investing in the company

- Retained earnings- the profit left after all deductions, including dividends, have been made, this is ‘ploughed back’ into the company as an internal source of finance

- The final section of the income statement shows how the profit for the year of the company is distributed between the owners- in the form of dividends to company shareholders, and a retained earnings

- The trading account

- The use of income statements

- It can be used to measure and compare the performance of a business over time or with other firms – and ratios can be used to help with this form of analysis

- The actual profit data can be compared with the expected profit levels of the business.

- Bankers and creditors of the business will need the information to help decide whether to lend money to the business.

- Prospective investors may assess the value of putting money into a business from the level of profit being made.

- Low-quality profit- one-off profit that cannot easily be repeated or sustained

- High-quality profit- profit that can be repeated and sustained

THE STATEMENT OF FINANCIAL POSITION

- Statement of financial position (balance sheet)- an accounting statement that records the value of a business’ assets, liabilities, and shareholders’ equity at one point in time

- The aim of most businesses is to increase the shareholders’ equity by raising the value of the business’s assets more than any increase in the value of liabilities

- Total value of assets – total value of liabilities = shareholders’ equity

- Liability- a financial obligation of a business that it is required to pay in the future

- Shareholders’ equity comes from two main sources-

- Share capital- the capital originally invested in the company through the purchase of shares

- Retained earnings- retained earnings of the company accumulated over time through its operations; these are sometimes referred to as reserves, which is rather misleading as they do not represent reserves of cash

- Non-current/fixed assets

- Assets that are to be kept and used by the business for more than one year

- Asset- an item of monetary value that is owned by a business

- The most common examples of fixed assets are land, building, vehicles, and machinery- these are all tangible assets as they have a physical existence

- Businesses can also own intangible assets that cannot be physically seen but still have value in the business- examples include patents, trademarks, copyrights, goodwill

- These items make up ‘intellectual property’- they can give a business greater market value than the total value of its tangible assets less its liabilities

- The reputation and prestige of a business that has been operating for some time also gives value to the business above the value of its physical assets- this is called the goodwill of a business and should normally only feature on a statement of financial position just after it has been purchased for more than its assets are worth, or when the business is being prepared for sale

- At other times, goodwill will not appear on company accounts – it is ‘written off’ as soon as possible if it has been included in the purchase of another company- this is because business reputation and good name can disappear very rapidly

- Assets that are to be kept and used by the business for more than one year

- Current assets

- Assets that are likely to be turned into cash before the next balance sheet date

- Examples

- Inventories- stocks held by the business in the form of raw materials, work-in-progress, and finished goods

- Trade receivables (debtors)- the value of payments to be received from customers who have bought goods on credit

- Cash/bank balance

- Current liabilities

- Debts of the business that have to be paid off within one year

- Examples

- Accounts payable- suppliers who have allowed the business credit

- Bank overdraft

- Unpaid dividends and tax

- Working capital

- The capital needed to pay for raw materials, day-to-day running costs, and credit offered to customers

- Current assets – current liabilities = Working capital

- Shareholders’ equity

- Shareholders’ funds- represents the share capital or retained earnings (reserves)

- Other reserves can show up on a business’ statement of financial position if they believe that its fixed assets have increased in value (revaluation reserve) or if it sells additional shares for more than their ‘nominal’ value (share premium reserve)

- Shareholders’ equity is the permanent capital of a business as it will not be repaid to shareholders unlike loans that are repaid to creditors

- Non-current liabilities (long-term)

- This the value of debts of the business that will be payable after more than one year- long-term loans owed by the business

- Examples- loans, commercial mortgages, debentures

CASH-FLOW STATEMENT

- This is the record of the cash received by a business over a period of time and the cash outflows from the business

- These statements help managers realise why a profitable business might be running out of cash

ACCOUNTING RATIO ANALYSIS

- Profitability ratios- these include the profit margin rations, which compare the profits of the business with revenue

- Liquidity ratio- these give a short-term measure of how easily a business could meet its short-term debts or liabilities

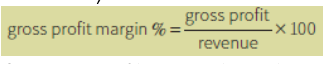

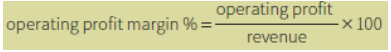

PROFIT MARGIN RATIOS

- These are used to assess how successful the management of a business has been at converting sales revenue into both gross profit and operating profit

- Widely used to measure the performance of a company and the performance of the management team

- Gross profit margin- this ratio compares gross profit (profit before deduction of overheads) with revenue

- Operating profit margin- this ratio compares operating profit with revenue

- Methods to increase profit margins

- Increase gross and operating profit margin by reducing direct costs

- Examples-

- Using cheaper materials

- Cutting labour costs

- Cutting labour costs by increasing productivity through automation

- Cutting wage costs by reducing workers’ pay

- Evaluation

- Consumers’ perception of quality may be damaged, and this could hit the product’s reputation. Consumers may expect lower prices, which may cut the gross profit margin.

- Quality may be at risk, communication problems with distant factories.

- Purchasing machinery will increase overhead costs (gross profit could rise but operating profit fall), remaining staff will need retraining – short-term profits may be cut.

- Motivation levels might fall, which could reduce productivity and quality.

- Examples-

- Increase gross and operating profit margin by increasing price

- Examples

- Raising the price of the product with no significant increase in variable costs

- Petrol companies increasing prices by more than the price of oil has risen

- Evaluation

- Total profit could fall if too many consumers switch to competitors – this links to price elasticity.

- Consumers may consider this to be a ‘profiteering’ decision and the long-term image of the business may be damaged.

- Examples

- Increase operating profit margin by reducing overhead costs

- Examples

- Moving to a cheaper head office location.

- Reducing promotion costs.

- Delayering the organisation.

- Evaluation

- Lower rental costs could mean moving to a cheaper area, which could damage image.

- Cutting promotion costs could lead to sales falling by more than fixed costs.

- Fewer managers – or lower salaries – could reduce the efficient operation of the business.

- Examples

- Increase gross and operating profit margin by reducing direct costs

- Liquidity ratios

- These ratios assess the ability of the firm to pay its short-term debts

- They are an important measure of the short-term financial health of a business

- Concerned with the working capital of the business

- Methods to increase liquidity

- Sell off fixed assets for cash – could lease these back if still needed by the business

- Examples

- Land and property could be sold to a leasing company.

- Evaluation

- If assets are sold quickly, they might not raise their true value.

- If assets are still needed by the business, then leasing charges will add to overheads and reduce operating profit margin.

- Examples

- Sell off inventories for cash (this will improve the acid-test ratio, but not the current ratio)

- Examples

- Stocks of finished goods could be sold off at a discount to raise cash.

- JIT stock management will achieve this objective.

- Evaluation

- This will reduce the gross profit margin if inventories are sold at a discount.

- Consumers may doubt the image of the brand if inventories are sold off cheaply.

- Inventories might be needed to meet changing customer demand levels – JIT might be difficult to adopt in some industries.

- Examples

- Increase loans to inject cash into the business and increase working capital

- Examples

- Long-term loans could be taken out if the bank is confident of the company’s prospects.

- Evaluation

- These will increase interest costs.

- Examples

- Sell off fixed assets for cash – could lease these back if still needed by the business

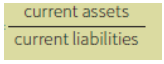

- Current ratio

- Current ratios can be expressed as a ratio or as a number

- Many accountants recommend a current ratio of around 1.5–2, but much depends on the industry the firm operates in and the recent trend in the current ratio.

- Very low current ratios might not be unusual for businesses, such as food retailers, that have regular inflows of cash that they can rely on to pay short-term debts

- Current ratio results over 2 might suggest that too many funds are tied up in unprofitable inventories, trade receivables and cash and would be better placed in more profitable assets, such as equipment to increase efficiency.

- A low ratio might lead to corrective management action to increase cash held by the business. Measures might include sale of redundant assets, cancelling capital spending plans, share issue, taking a long-term loan.

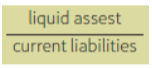

- Acid-test ratio

- Quick ratio; a stricter test of a firm’s liquidity

- It ignores the least liquid of the firm’s current assets- inventories (stocks)

- By eliminating the value of inventories from the acid-test ratio, the users of accounts are given a clearer picture of the firm’s ability to pay short-term debts

- Current assets – inventories = Liquid assets

- Firms with very high inventory levels will record very different current and acid-test ratios. This is not a problem if inventory levels are always high for this type of business, such as a furniture retailer. It would be a cause for concern for other types of businesses, such as computer manufacturers, where stocks lose value rapidly due to technological changes.

- Whereas selling inventories for cash will not improve the current ratio – both items are included in current assets – this policy will improve the acid-test ratio as cash is a liquid asset, but inventories are not

- It ignores the least liquid of the firm’s current assets- inventories (stocks)

LIMITATIONS OF RATIO ANALYSIS

- The four ratios studied give an incomplete analysis of a company’s financial position.

- One ratio result on its own is of very limited value – it needs to be compared with results from other similar businesses and with results from previous years to be more informative.

- Comparing results with those of other businesses should be done with caution. Different businesses may have slightly different ways of valuing assets and some accounts may have been window-dressed

- Window-dressing- presenting the company accounts in a favourable light to flatter the business performance

- Poor ratio results only highlight a potential business problem – they cannot by themselves analyse the cause of it or suggest potential solutions to the problem.

- Financial statements can only measure quantitative performance, and this is true of the ratios based on them. Other information of a qualitative nature is necessary before the full picture of a company’s position and performance can be fully judged.

INTERNAL AND EXTERNAL USERS OF ACCOUNTING INFORMATION

- Business managers

- to measure the performance of the business to compare against targets, previous time periods and competitors

- to help them take decisions, such as new investments, closing branches and launching new products

- to control and monitor the operation of each department and division of the business

- to set targets or budgets for the future and review these against actual performance

- Banks

- to decide whether to lend money to the business

- to assess whether to allow an increase in overdraft facilities

- to decide whether to continue an overdraft facility or a loan

- Creditors such as suppliers

- to see if the business is secure and liquid enough to pay off its debts

- to assess whether the business is a good credit risk

- to decide whether to press for early repayment of outstanding debts

- Customers

- to assess whether the business is secure

- to determine whether they will be assured of future supplies of the goods they are purchasing

- to establish whether there will be security of spare parts and service facilities

- Government

- to calculate how much tax is due from the business

- to determine whether the business is likely to expand and create more jobs and be of increasing importance to the country’s economy

- to assess whether the business is in danger of closing down, creating economic problems

- to confirm that the business is staying within the law in terms of accounting regulations

- Investors such as shareholders in the company

- to assess the value of the business and their investment in it

- to establish whether the business is becoming more or less profitable

- to determine what share of the profits investors are receiving

- to decide whether the business has potential for growth

- if they are potential investors, to compare these details with those from other businesses before making a decision to buy shares in a company

- if they are actual investors, to decide whether to consider selling all or part of their holding

- Workforce

- to assess whether the business is secure enough to pay wages and salaries

- to determine whether the business is likely to expand or be reduced in size

- to determine whether jobs are secure

- to find out whether, if profits are rising, a wage increase can be afforded

- to find out how the average wage in the business compares with the salaries of directors

- Local community

- to see if the business is profitable and likely to expand, which could be good for the local economy

- to determine whether the business is making losses and whether this could lead to closure

LIMITATIONS OF PUBLISHED ACCOUNTS

- Companies will only release the absolute minimum of accounting information, as laid down by company law

- Sole traders, do not have to disclose any information at all to the public, but may be asked to provide accounts to their bankers and the tax authorities

- Information that does not have to be published in a company’s annual report and accounts include:

- details of the sales and profitability of each good or service produced by the company and of each division or department

- the research and development plans of the business and proposed new products

- the precise future plans for expansion or rationalisation of the business

- the performance of each department or division

- evidence of the company’s impact on the environment and the local community – although this social and environmental audit is sometimes included voluntarily by companies

- future budgets or financial plans

- In addition, the data given are all past data for the last financial year and this information could be several months old by the time the accounts are published

- Only the internal management of the business will have access to all past accounting records and future plans, presented to them in as much detail as they request, by management accountants

WINDOW-DRESSING OF PUBLISHED ACCOUNTS

- No company can publish accounts that it knows to be deliberately and illegally misleading because they are checked by an independent firm of accountants known as auditors- there is an auditor’s report in every published account

- However, accounting decisions may require judgement and estimation- these judgements can often lead to differences in opinions between accountants

- Common ways of window-dressing accounts include:

- selling assets, such as buildings, at the end of the financial year, to give the business more cash and improve the liquidity position – these assets could then be leased or rented back by the business

- reducing the amount of depreciation of fixed assets, such as machines or vehicles, in order to increase declared profit and increase asset values

- ignoring the fact that some customers (trade receivables) who have not paid for goods delivered may never pay – they are ‘bad debts’

- giving stock levels a higher value than they are probably worth

- delaying paying bills or incurring expenses until after the accounts have been published