Double Entry

Every transaction has two entries – one on the debit side and one on the credit side. This is seen when making journal entries, as information is posted to two or more accounts for every transaction. Double-entry book-keeping involves taking the information from the journal and posting it to the respective ledgers

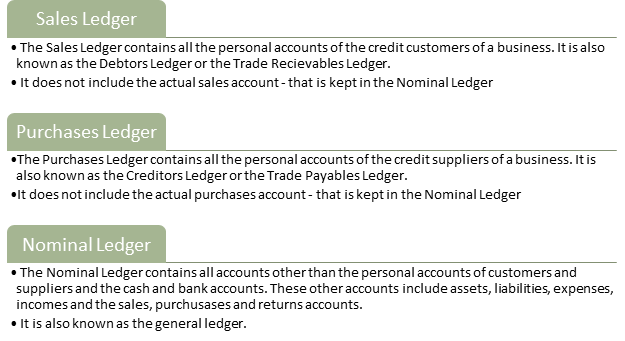

TYPES OF LEDGERS

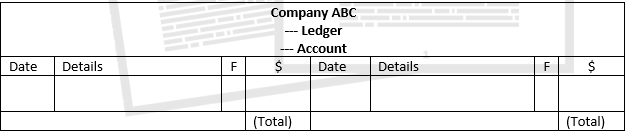

NOTE: The Folio column is used in a business to show the page number of the account being referenced. It will usually not be used during the examples, but it is still important to include when drawing the journal or the ledger.

FORMAT OF THE LEDGER ACCOUNTS

Depending on the type of account, the balances which are brought down (Value at the beginning of a period) or carried forward (Value at the end of a period) are either kept on the debit side or on the credit side. When it comes to specific accounts, such as purchases or sales accounts, the balancing figures are transferred to the income statement instead.

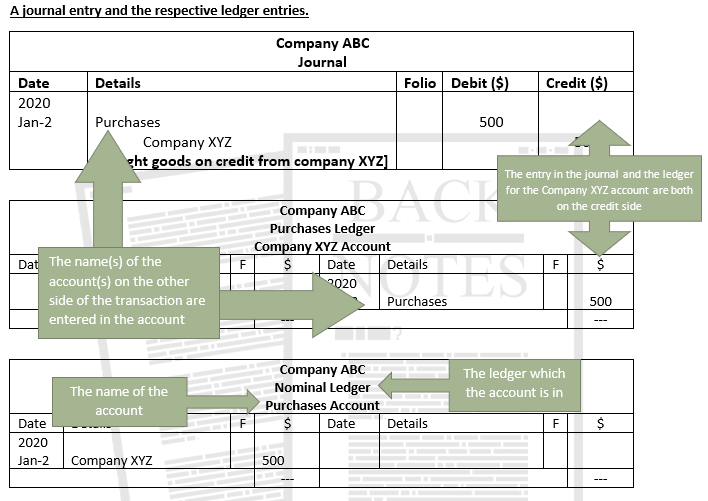

LEDGER ENTRIES

When making the ledger entries, the journal must be referred. The journal entry shows the accounts involved and the amounts involved in the transactions, so it can be used to make the correct entries in the individual ledgers.

BALANCING ACCOUNTS

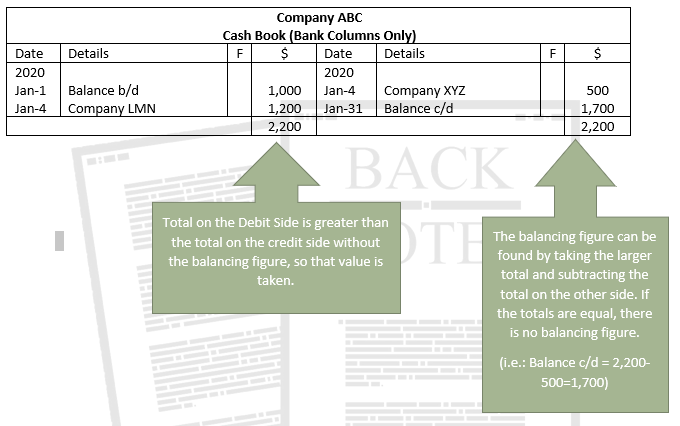

- At the end of each period, it is important to balance the accounts. Naturally, the two sides of the account would have different totals, so it is important to find the balance. The balance at the end of one period is equal to the balance at the beginning of the next.

- Balance brought down can be simplified to ‘Balance b/d,’ and balance carried down can be simplified to ‘Balance c/d’

- The totals on both sides should equal. In some accounts, such as expenses and income accounts, the balancing figure is not ‘balance c/d,’ but rather ‘transfer to the income statement.’ some accounts also have both balance and transfers.

- In a bank account, if the balance b/d down is on the debit side, then it is an asset, but if it is on the credit side, it is a liability. The credit balance is known as ‘bank overdraft,’ and it is when the company takes more money from the bank than they have in their account.